Fractional real estate is emerging as a transformative model in Egypt’s property investment landscape, offering a more accessible and flexible approach to ownership amid soaring property prices and shifting market dynamics. This model allows multiple investors to collectively own a share of high-value real estate assets such as vacation homes, commercial spaces, or luxury apartments, thus lowering the financial barrier to entry and democratizing access to prime property opportunities. In a market where affordability is a growing concern, especially among younger generations, fractional ownership provides a viable alternative that aligns with evolving preferences for asset diversification and minimal long-term commitment.

It also offers potential for steady rental income, capital appreciation, and reduced risk through shared responsibility. With the rise of proptech platforms and increased digitalization in Egypt’s real estate sector, the infrastructure to support fractional ownership is rapidly maturing. Legal frameworks and regulations, however, remain in development and will be crucial in safeguarding investors’ rights and ensuring transparency. As developers and financial institutions explore innovative models to attract new capital, fractional real estate could unlock significant value in underutilized segments, stimulate secondary market activity, and contribute to broader economic inclusion. If effectively regulated and marketed, it has the potential to redefine property ownership in Egypt, bridging the gap between traditional real estate models and the aspirations of a digitally-savvy, investment-conscious population.

KEY TOPIC OF DISCUSSION

SESSION 1: MARKET LANDSCAPE, LEGAL FRAMEWORK AND INVESTMENT VEHICLES:

- Current market trends driving interest in fractional ownership.

- Demand from middle-class investors, expats, tourism, and diaspora.

- Opportunities in coastal and emerging urban markets.

- Current ownership laws related to fractional models.

- Need for distinction between fractional ownership vs. timeshare/joint ownership.

- Current legal barriers to registration, title deeds, dispute resolution.

- Role of REITs and real estate funds.

- Integration of funds and hybrid structures.

- Institutional support & managed fund models.

- Whether fractional ownership works better for vacation homes, rentals, offices, retail, logistics, etc.

- Where investors’ demand and profitability are higher.

- Return models for developers, investors, and operators.

- Pricing transparency and valuation standards.

- Fees, maintenance, and investor obligations.

- Return models for developers, investors, and operators.

- Pricing transparency and valuation standards.

- Fees, maintenance, and investor obligations.

SESSION 2: MARKET SEGMENTS, EXIT MECHANISMS AND TECHNOLOGY ENABLERS:

- How digital platforms handle selling and managing fractional units.

- How identity verification (KYC), client onboarding, and secure transactions work in fractional platforms.

- How blockchain & smart contracts make ownership clear, safe & legally recognized.

- What rules, licenses, and approvals are required for fractional projects to operate in Egypt.

- Taxation issues, cross-border investments, Central Bank or FRA oversight.

- Protecting the rights of all co-owners.

- How to protect financial data, ownership records, and personal information of investors.

- What the industry, regulators, and investors need to align on to move forward successfully

SESSION 1 SPEAKERS

MODERATOR

Eng. Fathallah Fawzy

Vice Chairman of the Egyptian Businessmen’s Association and Chairman of the Real Estate Development and Contracting Committee

Dr. Eng. Abdelkhalek Ibrahim

Deputy Minister of Housing, Utilities and Urban Communities

Dr. Mostafa Mounir

Tourism Development Authority

CEO

Mr. Mohamed Youssef

General Authority of Investment and Free Zones (GAFI)

CEO Advisor

Eng. Tarek Shoukry

Chairperson of the Real Estate Development Industry Chamber and Deputy of the Housing Committee in the House of Representatives

Mr. Salah Katamish

Madinet Masr – SAFE

Senior Vice President Strategy & Investments

Mr. Mostafa El-Beltagy

Nawy

Co-Founder & CEO

Eng. Ahmed Mansour

Cred Developments

CEO

Mr. Hossam Gramon

Adsero Law Firm

Partner

Eng. Bedeir Rizk

Paragon Developments

CEO

Mr. Magdy ElYamani

Emtelaak Investments

General Manager

Dr. Raymond Ahdy

Wadi Degla Developments

CEO

Dr. Mohamed Abd El Gawad

Vantage Developments

Founder and Chairman

Mr. Ahmed El Dessouky

Valda Developments

Managing director

Eng. Mohamed Taher

Nile Developments

Chairman

Mr. Ahmed Sakr

SDC, Farida

Founder & CEO

Mr. Amr Elkady

AKD Advisory

Founder & Managing Director

SESSION 2 SPEAKERS

MODERATOR

Mr. Amr Elkady

AKD Advisory

Founder & Managing Director

Mr. Salah Katamish

Madinet Masr – SAFE

Senior Vice President Strategy & Investments

Mr. Mostafa El-Beltagy

Nawy

Co-Founder & CEO

Mr. Ayman Elsawy

Bokra Holding Company

Founder & CEO

Mr. Ayman Magdy

Nawy Shares

Managing Director

Mr. Hossam Gramon

Adsero Law Firm

Partner

Eng. Bedeir Rizk

Paragon Developments

CEO

Mr. Waleed Shaarawy

Emtelaak Investments

Chief Technology Officer

Mr. Ibrahim Hassan

Digified

CEO

Mr. Walid Hassouna

valU

Founder & CEO

Mr. Ahmed Sakr

SDC, Farida

Founder & CEO

Eng. Amr Afifi

Amtaar

Co-Founder

Mr. Mohamed El Khatieb

Seqoon

COO

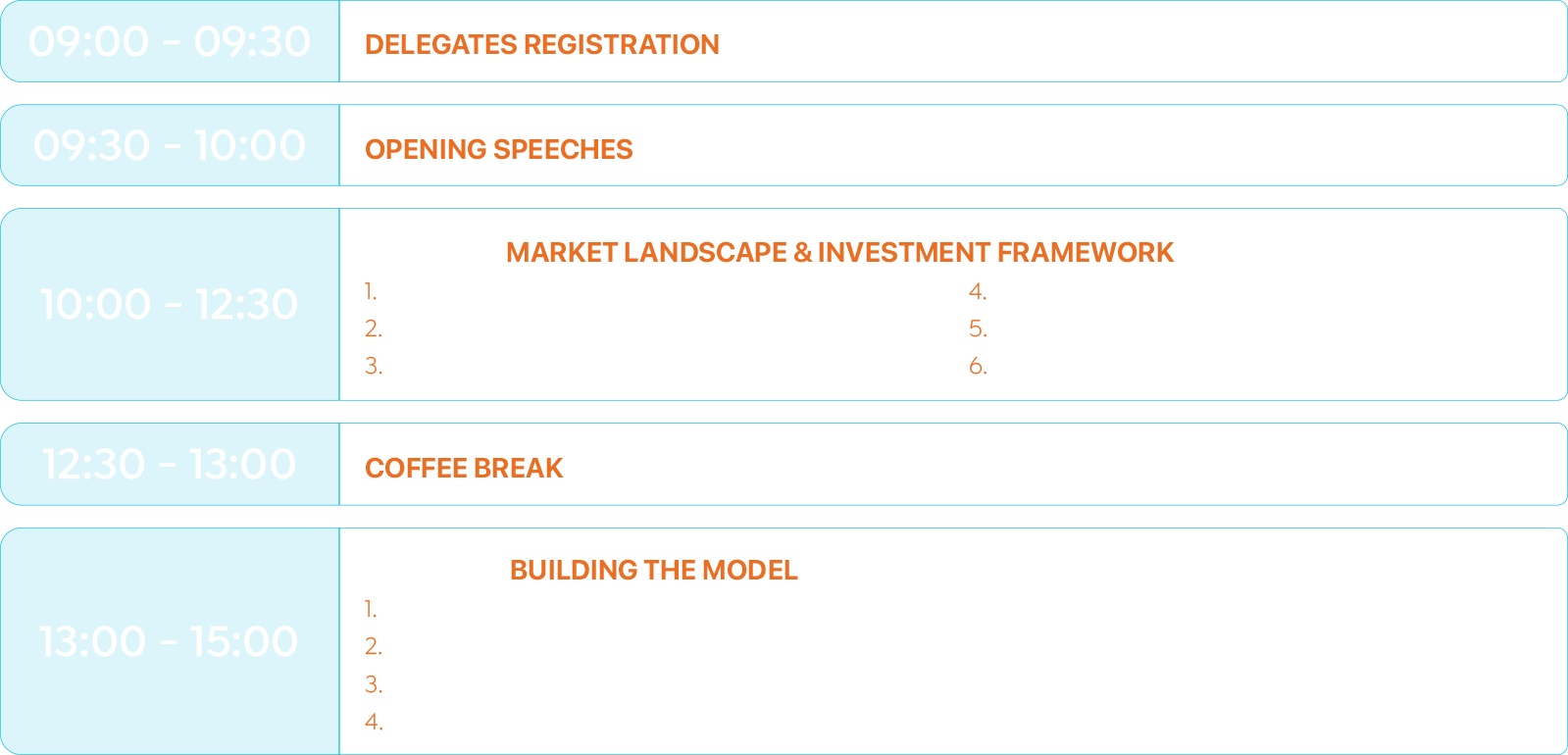

THE AGENDA